A Quick Guide to Residual Value in Leasing

To make a fully informed decision about your end-of-lease options, you’ll need to know just a thing or two about your car’s residual value. We’ll try to keep things bite-sized here – we know you’re busy.

What is Residual Value?

When your lease contract was prepared, your lender made an educated guess for what your car would be worth at the end of your lease. You’ve heard the saying that a car loses value as soon as it’s driven off the lot? There’s truth to that statement. After you’ve been driving the car for the entirety of your lease term? The value of the car depreciates quite a bit.

So, based on historical data and a few in-house tricks, your lender makes an estimate as to just how much the car will depreciate (lose value) over your lease term. The estimated value of your leased car after your lease term is its residual value.

Although it’s an estimate, it’s a very educated guess, so lenders aren’t usually far off from the actual value of your car at lease-end. However, special circumstances can make the actual value of your car at lease-end way off from the estimated residual value – and this can be good or bad for you. We’ll talk about why, but first we need to quickly explain how residual value is calculated.

How is it Calculated?

The residual value is the estimated value (or, in even simpler terms, cost) of your leased car at the end of your lease term. A standard term is 3 years, so generally speaking, the residual value should reflect the depreciation of your car over 3 years.

Lenders and manufacturers usually have their own ways of estimating this value. There’s a lot of factors that go into calculating residual value (like make, model, base-price for the vehicle, market trends, risk of lending the vehicle, etc.), so there’s not one standard formula. However, residual value can be roughly estimated by looking at the average depreciation of that make and model in recent years and applying it to a 3-year period with your (once new) leased car.

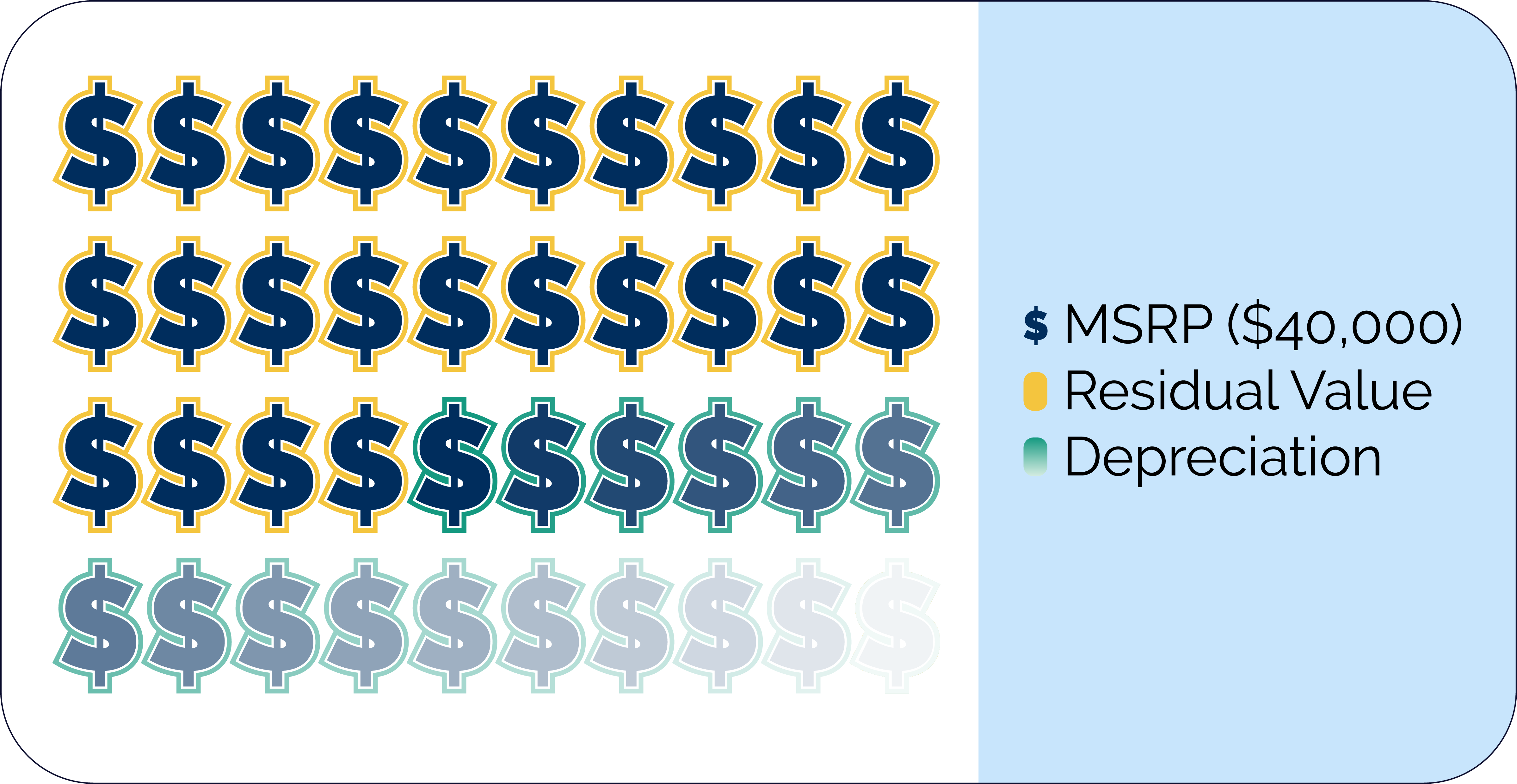

As a quick example, if your car’s MSRP (Manufacturer’s Suggested Retail Price) was $40,000, and your residual value is $24,000, your lender predicted that your car would lose 40% of its value (or $16,000) over that 3-year lease period.

Why Does it Matter?

Your car’s residual value is mainly important if you’re thinking about a lease buyout. If you buy out your leased vehicle to keep it, you’ll have to pay (or finance) the buyout amount. The buyout amount is usually composed of the car’s residual value, plus some extra fees associated with the transaction.

When deciding to buy out your leased car, you’ll want to compare the car’s residual value (and, therefore, the buyout amount) with current market values for your vehicle. Since the residual value is an estimate, it may not always be on the money. If the residual value is significantly higher than the car’s market value, a buyout may not be your best option based on residual value alone. If, however, the residual value is lower than the car’s market value, you could take advantage of a good deal on a car you’ve already started building equity in.

The Bottom Line

We promised we’d keep things short – hopefully you feel like we delivered. If you do want to go a bit more in-depth about residual value, we’ve got some other articles like this one on our blog that you can dig in to when you’ve got the time.

The bottom line is, you don’t need to worry about calculating residual value yourself – all you need to worry about is factoring that residual value into a good decision about how to end your lease. If you’re already leaning towards buying out your leased car and the residual value is lower than market value, that can be an amazing extra incentive towards that option. If the residual value is higher that your car’s current worth, you won’t necessarily need to change all your plans – you’ll just need to weigh your options a bit more carefully.

If you want to chat through your specific situation and choices, our Lease End Success Team is full of lease-end experts that can help, and you can give them a call at (888) 307-5197. If you’re ready and want to get started on a new, easy way to end your lease entirely online, you can visit us at leaseend.com to buy out your leased car from the comfort of your own home.

Enter Your License Plate to Get Started.