Dealership Fees on a Lease Agreement: Case Study

On our blog, we've mentioned some outrageous fees dealerships can charge customers when entering or ending a car lease. The truth is, most of the time these unnecessary fees won’t be obvious. They may even seem like a good idea after a quick glance and sly explanation from your salesperson. Unfortunately, it sometimes takes a trained eye to notice these upcharges.

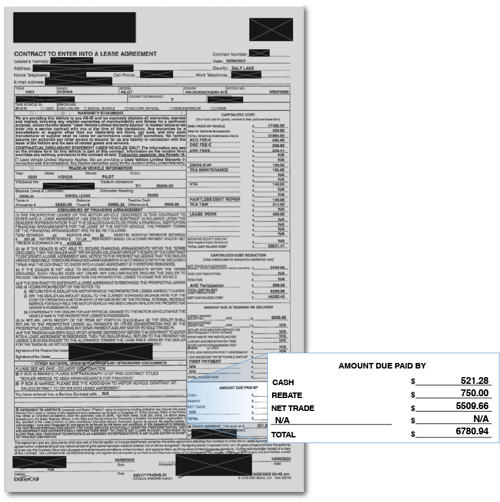

A friend of ours allowed us to take a look at their recent Contract to Enter Into a Lease Agreement so we could take a closer a look into how dealerships sell their clients on added fees day-to-day. Keep in mind that dealership practices vary, so these may not apply to (or look the same on) every contract.

A Lease Agreement and Contract To Enter Into a Lease Agreement are, actually, two different and distinct documents. The Contract leads to a Lease Agreement, and is more or less an easy way for the dealership to present your final costs and numbers without them spread across multiple pages. You should note that the money factor and residual value for your lease will be on that Lease Agreement.

We're about to dive into this Contract to Enter Into a Lease Agreement - here's how we'll break it down.

👍 Standard Fees - These fees are very common. You'll find them on pretty much every lease agreement across the board. While we encourage you (and everyone who enters into a lease) to ask plenty of questions when reviewing your lease agreement to make sure you understand everything, these usually require the least scrutiny.

🤔 Fees to Watch - These are what we call 'yellow light' fees - they're not inherently shady, but you should proceed with caution. Make sure to keep an eye out for them and follow up with your dealer for details.

😡 Bad Fees - If you see a fee like this, it's very likely that your dealership tacked it on for a bit of extra cash for themselves. Fees like these are generally bogus and you should try to get them removed for a better deal.

You’ll also want to know the definition of ancillary fees before we dive in. Ancillary fees are charges that are related to a transaction, but not built in to the price of the product or service. For example, if you buy a plane ticket for a trip, the ticket price is the ‘base’ price for the flight. If you check a bag, you may have to pay an additional fee for it – that’s an ancillary fee. A service charge on a concert ticket or an ‘activities fee’ paid along with school tuition would also be ancillary fees.

Ready? Let's jump in.

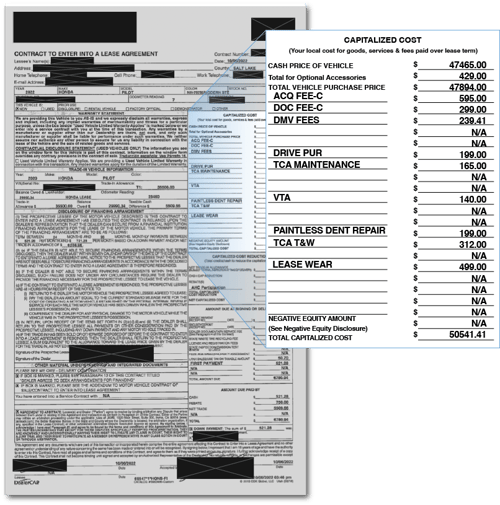

Section 1 - Capitalized Cost

Cash Price of Vehicle: The “sticker price” of the car.

Cash Price of Vehicle: The “sticker price” of the car.

🤔 Total for Optional Accessories: “Optional accessories” can refer to something the customer chose to add on, or accessories the dealership added while the vehicle was up for sale.

Total Vehicle Purchase Price: (Cash Price of Vehicle) + (Total for Optional Accessories)

🤔 ACQ FEE-C: This is most likely an acquisition fee that the manufacturer (here, Honda) charges. Acquisition fees are supposed to cover transportation costs. Often, this fee is not charged for a vehicle purchase.

👍 DOC FEE-C: These are pretty standard, and generally cover in-office costs and processing.

👍 DMV FEES: These are also very common and are intended to cover things like registration costs.

😡 DRIVE PUR: This is likely the dealership charging to sanitize the vehicle, maybe using a “special” cleaning product. Be careful – it’s possible that some dealerships raised or added this cost during Covid and may not get rid of it anytime soon. This is an ancillary product.

🤔TCA Maintenance: This is assessed to cover predictable and included maintenance costs over the course of the lease. On the one hand, paying up front like this could actually save you money over time. On the other, since this is an ancillary fee, it wouldn’t be prorated or cancelled if, say, the car is totaled two weeks after you drive it off the lot and you never get to use it.

🤔 VTA: This covers anti-theft tech (like stickers) that dealerships will often install on their vehicles. While there are some real benefits to something like this, it’s still a dealership-added cost. This is an ancillary product.

🤔 Paintless Dent Repair: Similar to the TCA Maintenance fee above, this is basically a pre-payment for any potential dent repair on the car. This is ancillary.

🤔 TCA T&W: Another pre-paid maintenance fee, this time for tire and wheel after-market products. This is ancillary.

🤔 Lease Wear: Similar to the fees above (yet again), this fee is more or less built in to cover any potential damage.

The sum of the above gives us the Total Capitalized Cost.

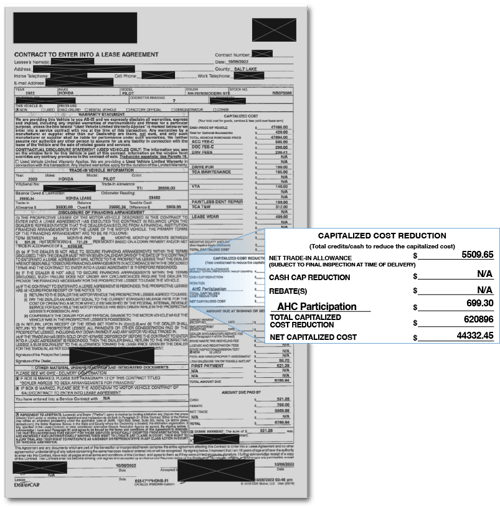

Section 2 - Capitalized Cost Reduction

Net Trade-In Allowance: This is the dollar amount taken off the Total Capitalized Cost due to any positive equity that can be applied to the sale (i.e. from a turn-in, which this customer did).

Net Trade-In Allowance: This is the dollar amount taken off the Total Capitalized Cost due to any positive equity that can be applied to the sale (i.e. from a turn-in, which this customer did).

Cash Cap Reduction: Although there aren’t any fees here, we wanted to point it out. This is usually presented as an option for a customer to put additional money down on their lease to lower monthly payment costs. Our honest opinion? Don’t do this.

AHC Participation: This price reduction is usually granted when a customer qualifies for a retention rebate. A retention rebate is a discount you may get for being a repeat customer. (This customer has probably worked with Honda in the past.)

Total Capitalized Cost Reduction: (Net Trade-in Allowance) + (AHC Participation)

Net Capitalized Cost: (Total Capitalized Cost) – (Total Capitalized Cost Reduction)

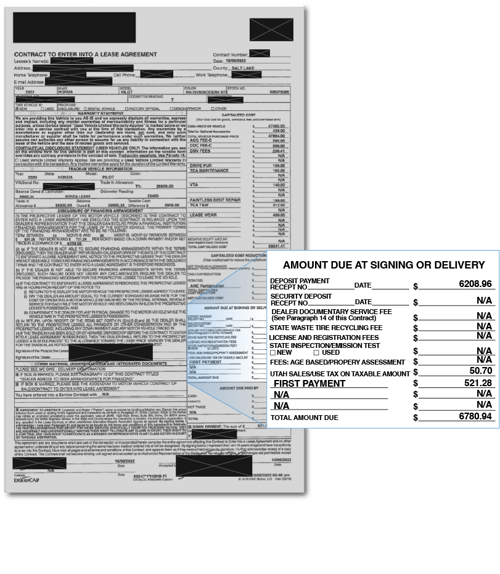

Section 3 - Amount Due at Signing or Delivery

Deposit Payment: This refers to any deposit, down payment, rebate, trade-in, etc. that will be applied to the transaction. In most cases, if you have a trade-in it’ll be due at signing.

Deposit Payment: This refers to any deposit, down payment, rebate, trade-in, etc. that will be applied to the transaction. In most cases, if you have a trade-in it’ll be due at signing.

👍 Utah Sales/Use Tax: This is your state sales tax.

First Payment: This is usually due on the first day of a lease.

Total Amount Due: This equals the First Payment + Deposit Payment + Utah Sales/Use Tax. In practical terms, this means that the customer would be paying the cash amount of the First Payment + Utah Sales/Use Tax, and would have to hand over their trade-in at signing. To note: If this customer wasn’t trading a car in, this would be where the dealership charges a lease down payment (you’d also see this as the “Cash Cap Reduction” line item above). Lenders determine down payment amounts.

Section 4 - Amount Due Paid By

Cash: This refers to their first payment.

Rebate: This is likely a discount the dealership has worked out with this specific customer.

Let's Wrap It Up

Not all dealerships have your best interests in mind, but that doesn’t mean you can’t come prepared. Do all the research you can on both your future car and its manufacturer before signing your lease agreement. If possible, try to negotiate your fees and final cost with the dealership before they hand you your deal on paper.

You can also check out our article about what questions to consider before starting and ending your lease so you know what to ask the dealership (and yourself) before signing anything. Concerned about hidden fees from dealership at the end of your lease, too? This article goes over some of the most common end-of-lease charges you'll need to watch out for.

When it does come time to end your lease (or if you’re in one right now), work with Lease End to get the most out of your leased vehicle and keep your car. Give us a ring at (888) 307-5197 or visit leaseend.com to learn more. (Or, get started below.)

Enter Your License Plate to Get Started.